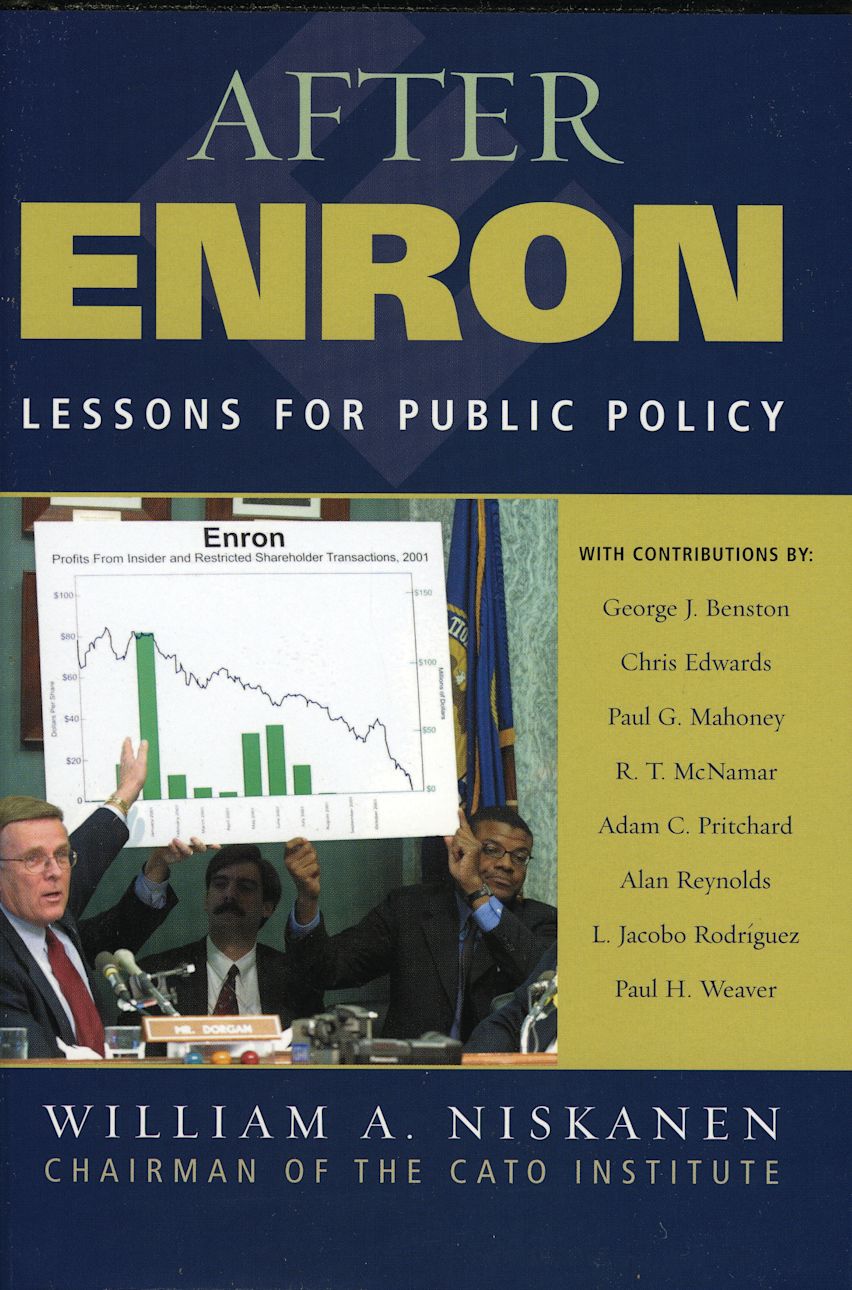

After Enron

Lessons for Public Policy

After Enron

Lessons for Public Policy

For information on how we process your data, read our Privacy Policy

Thank you. We will email you when this book is available to order

You must sign in to add this item to your wishlist. Please sign in or create an account

Description

After Enron first describes the conditions that led to the collapse of Enron and other corporate scandals and the concerns that these developments raised among the public, the press, and political officials. The book then describes and evaluates the initial private and public responses to these developments and concludes that most of these responses were unnecessary, harmful, or inadequate.

There are four major lessons learned during the post-Enron scandal era:

Don't count too much on financial accounting.

Don't count too much on auditing.

The tax system is an important part of the problem.

The rules of corporate governance do not adequately serve the interests of general shareholders.

After Enron addresses the major lessons for public policy affecting accounting, auditing, taxation, and corporate government. It proposes a set of policy changes to address the lessons learned from the Enron scandal. The first major set of proposed changes would delegate the authority to establish and monitor accounting and disclosure standards to each stock exchange. A second major proposal would replace the corporate income tax with a cash flow tax. And a final set of proposed policy changes would replace the rules of corporate governance that are now biased against the interest of the general shareholders. The most distinctive feature of the book is that the major proposed policy changes would address the problems illustrated by the corporate scandals by reducing and focusing the role of government.

Table of Contents

Chapter 2 A Crisis of Trust

Part 3 Private and Public Actions in Response to the Enron Collapse

Chapter 4 Major Private Responses

Chapter 5 Political Responses to the Enron Scandal

Part 6 Accounting

Chapter 7 Don't Count Too Much on Financial Accounting

Chapter 8 Corporate Accounting Before and After Enron

Part 9 Auditing

Chapter 10 Don't Count Too Much on Auditing

Chapter 11 The Formal Audit Process

Chapter 12 The Market Analysts

Chapter 13 Public and Private Rule Making in Securities Markets

Chapter 14 Should Congress Repeal Securities Class-Action Reform?

Chapter 15 The Business Press as a Corporate Monitor

Chapter 16 Lawyers as Corporate Monitors

Chapter 17 Bankers as Corporate Monitors

Chapter 18 The Credit Rating Agencies

Chapter 19 The SEC as a Corporate Monitor

Part 20 Taxation

Chapter 21 The General Problems of the U.S. Tax System

Chapter 22 Compensation, Journalism, and Taxes

Chapter 23 Replace the Corporate Income Tax with a Cash-Flow Tax

Part 24 Corporate Governance

Chapter 25 Corporate Governance

Part 26 Major Policy Lessons From the Collapse of Enron

Chapter 27 Major Policy Lessons from the Collapse of Enron

Chapter 28 Index

Product details

| Published | 29 Apr 2005 |

|---|---|

| Format | Ebook (Epub & Mobi) |

| Edition | 1st |

| Extent | 384 |

| ISBN | 9780742569577 |

| Imprint | Rowman & Littlefield Publishers |

| Publisher | Bloomsbury Publishing |

About the contributors

Reviews

-

Niskanen (chairman of the Cato Institute) presents the second book to result from his organization's project assessing the major policy lessons to be drawn from the collapse of the energy giant Enron....This collection of 20 papers consider broader issuers of corporate governance and regulation, including accounting problems and their alternatives, the failure of the entire Enron auditing chain, provisions of the tax code that influence the character of executive compensation and promote the conditions leading to backruptcy, and corporate governance rules that have shifted power to corporate managers relative to shareholders over the past few decades.

Reference and Research Book News

-

This is a stimulating and insightful view of the weaknesses of corporate governance and their monitors, and of government policy related to recent corporate scandals. Recommended.

Choice Reviews

-

After Enron should be read by all those interested in the regulatory state and the workings of the market place.

Frank Vibert, European Policy Forum

-

The big question in corporate governance these days is whether the pendulum has swung too far in the direction of regulation. It comes as no surprise to learn that the Cato Institute, the libertarian-minded Washington think tank, thinks it has. Cato has laid out its case in a book of short, accessible essays titled After Enron....It forces those of us who welcome most of these regulations to think hard and critically about them.

The Review of Higher Education